Alibaba’s Business & IPR Protection Summit 2019

Alibaba’s Business & IPR Protection Summit was held in London yesterday. The event was hosted by Alibaba, to showcase how the tech group can unlock business potential in China and the measures they put in place to protect intellectual property rights.

For those still unaware of the Alibaba Group, check out the brand & content management guide:

The summit

Attendees generally fell into two groups: SMEs wanting to learn about the tools Alibaba offers to sell into China, and larger brand owners wanting to discuss brand enforcement and content governance issues. I was lucky enough to bump into a few former colleagues / friends – those from the brand protection industry turned up mainly to cast a suspicious eye on Alibaba’s claims to be an industry leader in IPR protection.

Third-party speakers were invited to present, but as the event was organised and hosted by Alibaba, the information delivered must be considered with that kept in mind. The event forms part of the constant global roadshow of Alibaba to demonstrate how seriously they take IPR protection. A key point emphasised by numerous speakers was the sheer scale of the counterfeit issue across Alibaba platforms was a function of China being the world’s dominate manufacturer and Alibaba being the dominate ecommerce company. Generally, this point holds true – as long as China remains the global producer of goods, anti-counterfeiting strategies must prioritise the country within their brand protection strategy.

From offline traceability of the supply-chain to the digital channels of distribution, business in China comes with the risk of intellectual property infringement. Therefore, platforms must be judged in light of their willingness to work with brand owners and the measures taken to reduce the overall scale of infringement. Although, Napster was judged on the basis that developing technology to remove 99.4% of infringing content was not quite good enough as a digital rights protection measure. It has been almost 20 years since that famous decision was delivered, the internet has moved on from such binary labelling of platforms. If not, then Amazon, YouTube and Facebook couldn’t exist.

Another key point was for the tech giant to teach a western audience how much of a giant they are; leading in ecommerce, cloud computing and e-payments. To the extent of Alibaba presenters avoiding, or plainly refusing to mention WeChat by name – euphemistically referred to as ‘a competitor app’. Alibaba’s own chat app DingTalk, on the other hand, was mentioned many times; this is one of the few areas Alibaba do not fare so well, with WeChat having 10x more users. DingTalk is more targeted at enterprise users, although the communication and file sharing ecosystem is still some way behind in China. Also, with the ongoing security and privacy concerns over companies in China and the government means it is very unlikely any international enterprises would switch from Microsoft et al to DingTalk.

Switching back to the core areas, the summit was split into halves, the first session covered “making it easy to do business anywhere” with the second “protecting and enforcing intellectual property rights”. An unusual choice was to fill the IPR protection half mainly with third-party speakers, I assume this was to use the credibility and impartiality of external representatives to confirm Alibaba’s claim to be an industry leader. Representatives attended from rightsholders, politics, law enforcement, policy and academia to cover numerous angles.

I will focus on the Alibaba presenters and skip of the third-party presentations. The case studies from Smoothskin and eOne (owners of Peppa Pig) were fascinating and full of insight, both highly recommended if able to catch at another event in future. But I will stick to Alibaba representatives, therefore, we start with the presentation from David Lloyd, UK Manager Director at Alibaba.

Tech, not ecommerce

David Lloyd’s introductory session was to highlight the positioning of Alibaba, as a tech company, not an ecommerce company. Founder Jack Ma has long stated this point; Alibaba’s mission was to connect people and businesses, to provide the tools for trade and open up new markets to SMEs. Unlike US counterpart Amazon, Alibaba does not directly sell products on their ecommerce services to compete with third-party merchants. Manufacturing and sales are outsourced to merchants, whilst the Alibaba Group generates revenue from fees and advertisements.

The Group often uses the number of merchants and gross merchandise value sold as metrics of success to highlight the merchant-centric emphasis. The over 650 million monthly active users provide the incentive for merchants to sell on Alibaba ecommerce platforms. Now entrenched, the Group can focus on improving user experience and tools for merchants, to keep fuelling the ecosystem. Alibaba is also investing significantly in ‘new retail’, their term for physical stores blended with digital experiences, vertical integration with logistics supply-chain and helping SMEs digitise to compete in the modern economy.

Further to the sheer number of users on Taobao and Tmall was noting how strong the level of engagement shown by users and the overall reliance on digital marketplaces in China. David was not the only presenter to highlight the cultural preference of the Chinese to turn to Taobao for shopping, rather than “brand.com” or googling for webstores. Shopper instinct leads to Taobao, where the average user spends over 20 minutes per day browsing. I would suggest the average Amazon user does not find their user experience as engaging.

The final element of the presentation was a general display of Alibaba’s western integration. Including both bringing Premier League football to video platform Youku and Alipay’s sponsorship of the Nations League and 2020 European Championship. Surprisingly, Premier League clubs have failed to fully connect with football fans in China, attempts are being made with varying degrees of success, but it seems only a matter of time before this commercial avenue is properly utilised.

To enable & protect

Next was the first of three presentations, each which covered one of the core areas of the Group; cloud, payments and ecommerce. To start, Dr Jianhua Shao, Solutions Architect for Alibaba Cloud. The cloud computing division serves the entire Group operations, no easy task when the infrastructure must ramp up to support over $30 billion worth of transactions for a single sales event – 11.11 (aka Singles’ Day). The Dr gave some context to the scale, telling the story of how customers queue online until midnight, the first purchase is made within seconds of the clock ticking past midnight, then by the time it takes to drink a coffee $5 billion worth of stock is sold, eight minutes past midnight, the very first 11.11 delivery arrives at the door of the customer. The speed and scale of the task requires the expert combination of cloud computing, big data, AI and IoT to deliver a seamless user experience. With such capabilities to enable the Alibaba ecosystem it is not surprising that Alibaba Cloud is the number one cloud computing service provider in all of Asia Pacific; with AWS a distant second.

The Dr made another intriguing comment stating IP protection is always the highest priority. This led to a discussion about fingerprinting technologies, to monitor images of infringing products and then proactively remove listings which feature the images or similar images. Anyone who has shopped on Taobao and used the find the same or similar product functions will be aware of how powerful the image recognition software is. However, prioritising digital rights protection over security sounds unlikely from a division which has security at its heart. The comment does raise the point about how technology can be leveraged to protect intellectual property at scale, although behind many supposedly AI technologies is a layer of low-cost workers performing monotonous tasks to plug the service delivery gap.

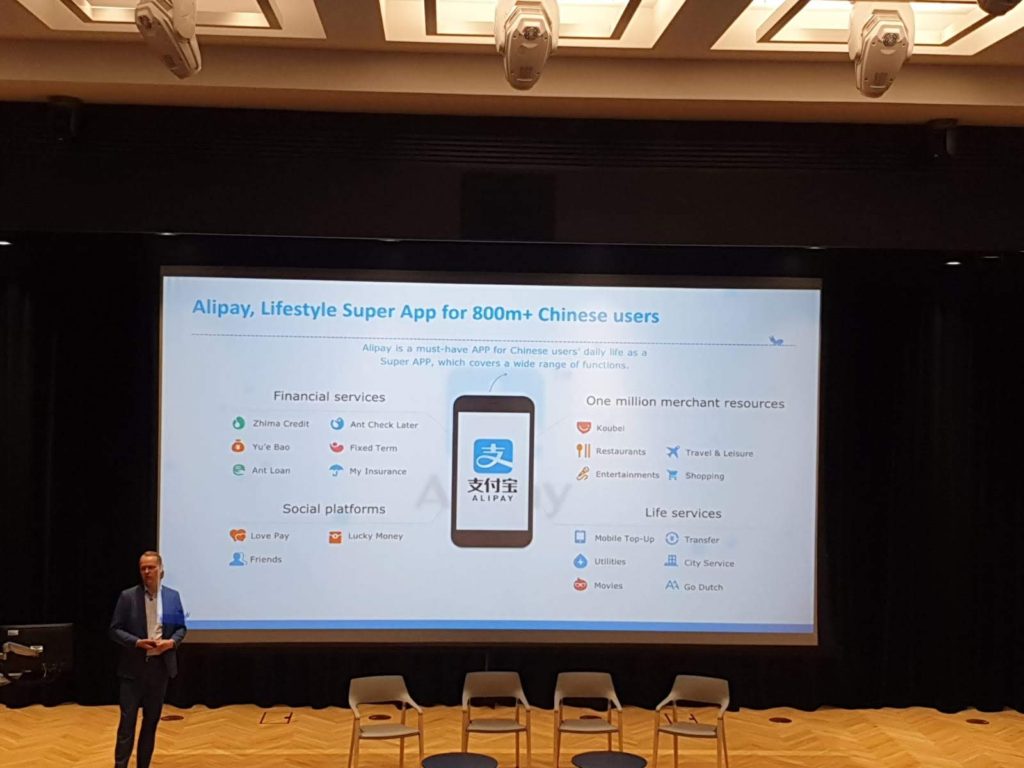

A lifestyle super app

Next up, covering the Group’s core area of payments was Head of Alipay Europe, Roland Palmer. Apple’s approach to encouraging e-payments in the west is to introduce Apple Card, a physical card to accompany digital services (Apple is also innovating the digital services too). Meanwhile, digital payments have become prevalent across China and the other major economies of Asia. Whilst the west struggles to catch up, Alipay has developed into more than just a payments app, into what was described as a lifestyle super app.

Users unfamiliar with the app, or rival offering WeChat Pay, fail to grasp the level of integration these mobile payment mechanisms have in everyday life in China. Roland Palmer spoke about a recent trip he made to China; he didn’t take any cash, using Alipay from the moment he touched down. Paying for a taxi to his hotel, for the hotel check-in process, at the local supermarket to his everyday expenditure – all covered using Alipay on his mobile phone.

The link with the UK was made via tourism – with Chinese tourism expected to soar to over 160 million per year. Europe was the preferred destination in a survey conducted regarding tourist travel choices; I have observed with increasing frequency the number of adverts in European airports of Chinese brands, including Alibaba companies and WeChat. Chinese tourism is vital to some industries – the sales of luxury goods can be directly correlated with Chinese tourism figures. And ‘when in Rome’ does not apply to this new mass market, as 90% of respondents in the survey stated they would use Alipay abroad if they could and as such would spend more money when Alipay was available. Pragmatic reasons for the desire to use Alipay, such as no currency exchange fees were given, but almost half the respondents also listed ‘the feeling of pride at seeing a Chinese brand be successful abroad’ as a motivating factor to wanting to use Alipay. It can be assumed the same applies to using WeChat Pay too.

Alipay was not just advertised as a replacement for existing payment methods, but a way to advertise, offer discounts and engage with potential customers. The app has a lot of functionality outside of payments and the closeness of the ads to the method of payment is likely to induce high conversion rates. Alipay also (annoyingly) delivers push notifications, such as stores close by offering discounts. A great feature for brand owners, less great for privacy (and your battery life).

Pace, partnership and patience

The final core business area presentation was from Mei Chen, Head of Fashion and Luxury. Her talk covered ecommerce across the Alibaba ecosystem. A ‘one size fits all’ approach to China was sharply dismissed, with a cultural explanation of the Chinese market helpfully provided. The earlier point about how Chinese consumers tend not to use “brand.com” or search engines, but go straight to Taobao was fleshed out with examples to prove Alibaba’s point. Based on the figures, Alibaba are correct and the statement is not mere marketing hyperbole.

Three consumer channels into China were presented, with a stepped approach to starting out. The first was selling on Taobao via an agent, this was to test the water and monitor if the item has a demand in China. Taobao provides access to the largest audience, however, to sell directly on Taobao, non-Chinese brands are required to register as a business entity in China. Therefore, using an agent is a useful precursor to determine whether registering in China makes commercial sense. Following from the initial testing, was to use Tmall Global – the benefit of this platform is the brand having the ability to sell directly to Chinese consumers without the need to register as a business entity. The downside is a much lower target audience. The third platform was Tmall, domestic version which overshadows the Global variant. Brand owners need to be registered in China and only Chinese trade mark registrations will be accepted for brand enforcement purposes on domestic Tmall. However, Tmall is where shoppers go for brands, interacting directly with brands via their Tmall store. An additional channel was appended to the list – going offline. This advice seems to be added to fit the ‘new retail’ strategy of the Group and advice will likely be further developed over time.

This presentation also touched on shopping festivals which attract enormous ecommerce activity, Alibaba’s own fashion show ‘Tmall Collections’ – which was described as a “must watch for mobile first Gen Z consumers”. The relatively young average age, just 32 years, of Taobao and Tmall users was noted alongside integration with platforms including the Gen Z favourite TikTok. The message was clear, shopping in China is entertainment. Brands need to excite customers, engage personally and provide attentive customer service, or otherwise face being drowned out in a competitive market. The approach to being successful in China was to build fast, get the right partnerships in place, whether that is ecommerce presence or use of influencers and then patiently build the brand. Profitability in year two was given as the benchmark for a new brand in China.

To lead in retail, we have to lead in IPR protection

The final Alibaba representative I am covering was delivered by Matthew Bassiur, Head of Global IP Enforcement. As the job title suggests, he discussed the tools available for brands to protect their IPR. IP protection fell under the remit of Platform Governance Team, including areas such as platform security, consumer and merchant education, brand cooperation and takedown processing.

Alibaba categorised IP protection into three general buckets, proactive enforcement, IP infringement reporting tools and offline action. Proactive covered the application of technology (and human moderators) to scan listings for infringements and remove before going live – a self-reported 96% success rate on this front. The IP Protection Platform was highlighted, with a how-to ‘practical tips’ supplemental session offered as an option at the end of the day for brand owners, specifically aimed at SMEs which may have not have previous experience with the platform. The offline element was provided as a long-term approach to reducing counterfeits at their source. This includes factory raids, arrests and even joint litigation (brand owner + Alibaba) against counterfeiters.

Key to the session was the discussion covering the industry first Alibaba Anti-Counterfeiting Alliance (AACA). This collection of over 120 members includes many of the most well-known western brands, which have given their legitimacy to Alibaba by supporting the initiative. Europe is the most represented territory, accounting for 33% of the brands. Perhaps reflecting reticence from some US rightsholders still exists? Or, the figures represent the success the program has had in attracting brands from industries in which Europe leads i.e. luxury goods. The US accounts for 27% of the brands though, whilst China only makes up 24%. The figures are from Alibaba’s annual report on IPR protection, a yearly update on the work the Group has done to work collaboratively with brand owners and successes in reducing the scale of counterfeits across core platforms.

Matthew Bassiur emphasised the importance of working with brand owners, trade associations and industry generally, including the MarketSafe program. Working with the International Anti-Counterfeiting Coalition to provide training and access to priority features, normally reserved for brands with a history of notice and takedown success on the platform. This approach encourages brands owners to work with Alibaba, as often approaching the tools for brand enforcement without any knowledge can seem impenetrable.

Closing remarks

The summit provided a great introduction to SMEs on the tools available to break into the Chinese market and how to protect their brand. The market still represents a double-edge sword, with an abundance of counterfeits and piracy on one side, but flipped around, a young, vibrant market with shopping tangled with entertainment and culture and a near insatiable appetite for both domestic and foreign brands. The opportunity is there for brands willing to prepare meticulously and then jump in.

For more information regarding IPR protection on Alibaba, see:

https://ipp.alibabagroup.com/